IRS Form 1040 ES for Quarterly Estimated Tax Payments

Two often quoted, but highly deceptive facts you might hear from someone “selling” Costa Rica is that Costa Rica does not tax income from foreign sources and that U.S. citizens abroad are entitled to the Foreign Earned Income Exclusion ($97,600 for 2013). Both statements are accurate, but can be misleading to those considering relocation abroad.

The first rude awakening is that income from a pension or Social Security is classified by the IRS as unearned income. So, if your net income is high enough, then you still be required to pay federal income tax on benefits while living in Costa Rica.

Before the era of banking transparency, it was common for a newly arrived expat to form a corporation in Costa Rica, and then start looking for ways to earn a living. Perhaps the most lucrative was flipping real estate. However, income from this activity is also classified as unearned income. A clever argument is that the land deal profits actually belong to the corporation, which pays an annual salary equal in amount to the exclusion. Unfortunately, this overlooks the 36 percent payroll tax (Caja) due in Costa Rica.

Another popular type of deal for expats is to invest in a call center or other services business with clients making payments from abroad. Indeed, this type of income enjoys some tax benefits, and a large business can also apply to setup in a free trade zone. This has the benefit of being able to import property and equipment free of the high sales and import taxes in Costa Rica.

Eventually, however the U.S. persons who own or control the corporation will need to pay taxes on their distributions. This fact is often ignored by expats operating in Costa Rica, some of which mistakenly think their corporate bank account is a personal checkbook.

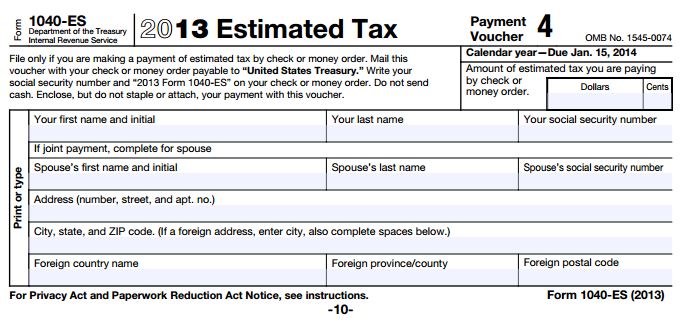

Perhaps a more common example is the expat who works at home in Costa Rica, selling online or providing professional services. Also known as working virtually, some expats like it because they receive payments in U.S. accounts and avoid getting legal in Costa Rica. Even those who have residency can benefit from this approach because it’s easier and cheaper than getting paid through Costa Rican accounts. Although payments to the account are subject to U.S. Self Employment Tax, these earn credit for Social Security. Even with the U.S. account an expat can qualify for the federal Foreign Earned Exclusion and in some cases, legally avoid state income tax.

Tax compliance is more complicated than ever in both Costa Rica and for U.S. persons living abroad. If you plan to setup a business in Costa Rica or work virtually, then it’s important to understand the rules. Taking advice from peers in Costa Rica on tax issues is a bad idea. Financial planning advice from those selling the dream in Costa Rica is a recipe for disaster.

Only a accounting professional who also understands the international issues can give you accurate tax advice. A book that I recommend is The Complete US Expat Tax Book. It’s available in both e-Book and paperback, and was updated this year. It addresses the important issues related to self-employment as well as the new FATCA rules.